The Golden Summit project is a large bulk tonnage gold project with significant room for expansion. The project is located a 30-minute drive from Fairbanks, the second-largest city in Alaska (population of the greater Fairbanks area is approximately 100,000), and serves as a major population and supply center for the interior region of Alaska.

|

|

GOLDEN SUMMIT 2022

Golden Summit was the subject of an extensive drilling campaign during 2011 – 2013 resulting in multiple resource updates that showed the potential for significant resource growth. This was followed by a preliminary economic assessment in 2016 using a $1300 gold price. In 2017, a limited drill program was undertaken aimed at expanding the existing in pit oxide resource.

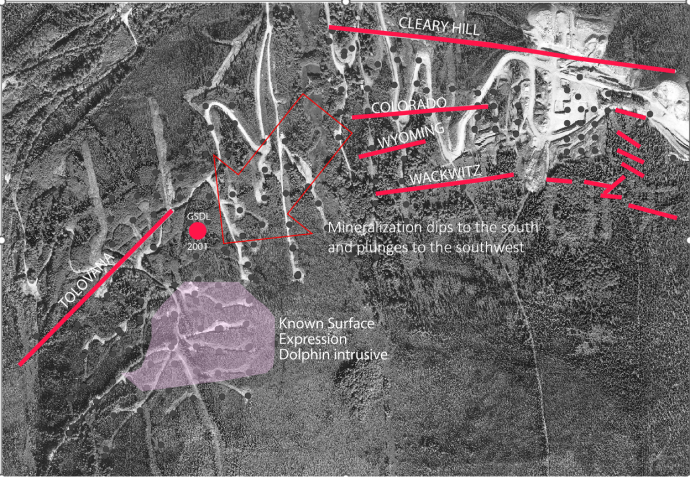

In 2019, following an extensive data review of past drilling and in conjunction with the resource model and block model level plans, Freegold identified what it believed to be the potential for a higher-grade corridor of mineralization extending from the area of the old Cleary Hill mine workings towards the Dolphin Intrusive. Based on this interpretation a drill program was initiated on the project in February 2020.

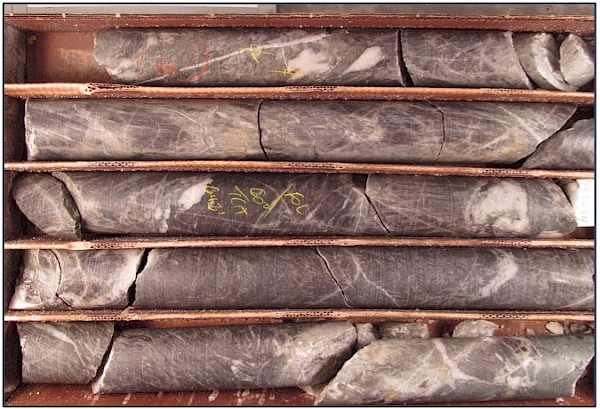

Hole GSDL2001 was the initial test of this hypothesis and returned 188 metres grading 3.69 g/t Au. Hole GSDL2001 encountered veins, veinlets and stockwork zones within areas of intense silification. These results further confirmed Freegold’s interpretation of a robust vein swarm system. Drilling resumed on the project in June of 2020 and continued until mid-December, with approximately 9000 metres drilled. Drilling recommenced in February of 2021 and during 2021 a further 38,000 metres were drilled in 68 holes, with an average hole depth of 600 metres. Assays are pending for several holes. Cutting and sampling continued over the winter break to expedite results as quickly as possible.

Drill results are continuing to return multiple intercepts of higher-grade mineralization within the projected extension of the CVS. The CVS is an interpreted corridor extending south from the old Cleary Hill mine workings towards the Dolphin intrusive and consists of broad zones of intense silicification and alteration that contain narrow high-grade veins, multiple veins, veinlets, stockwork zones and although the bulk of the current resource is hosted by the Dolphin intrusive, the extent of the Dolphin intrusive is not yet known. Dolphin is the likely driver of the mineralization found in the Cleary Hill area, which are found within the permissive pathways of schist and effectively form vein swarms. The Dolphin Cleary area currently covers an area of 1400 metres x 500 metres.

|

|

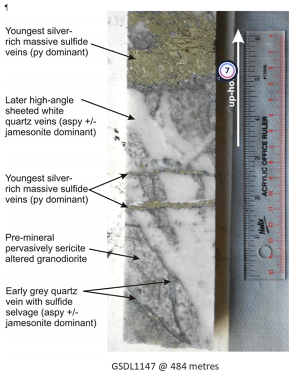

Photos from Hole GSDL2001: Collared in the immediate footwall of the Dolphin intrusive. Intense silification and veining throughout a broad zone.

GS2107 521.1 – 523.2m – 44 g/t Au

Photo from GS2122 – Visible gold noted in Core.

Photo: 1 GS2122 499 - 502m – 35.2 g/t Au

In February 2022 drilling resumed at Golden Summit. The initial 2022 program is a continuation of the 2021 program looking for higher-grade mineralization, with an initial 20,000 metres planned. Results from the 2020-2021 program to date have demonstrated the potential for more extensive and higher than resource grade gold mineralization on the project intersecting numerous assay intervals over 30 g/t Au, more than any previous program.

The current program has multiple objectives beyond expanding the existing resource and potentially increasing its grade but also to advance the project through pre-feasibility.

- Determining the orientation of the higher-grade mineralization

- Expanding the currently known resource and upgrading the resource categories as part of the efforts to further advance the project through pre-feasibility, including additional environmental baseline studies, further metallurgical test work, and cultural resource studies.

- Testing other targets on the project that may have the potential to host additional resources and host other buried intrusives throughout the project area. Ground geophysics and soil sampling have been conducted on these areas and further drilling is planned to test these other potential areas.

|

|

|

GOLDEN SUMMIT

Freegold acquired an interest in Golden Summit in mid-1991 and conducted exploration including geologic mapping, soil sampling, trenching, rock sampling, geophysical surveys, core, reverse circulation, and rotary air blast drilling on the project. Drilling completed by Freegold on the Project between 1991 and 2009 totaled 26,902 metres of core and reverse circulation drilling in 214 holes and 26,640 metres of rotary air blast drilling in 2,028 holes before a comprehensive property compilation was completed in 2010. This compilation identified the potential to delineate a resource in the Dolphin area. A ground-based geophysical survey on the Dolphin area was also undertaken which indicated that the alteration in the Dolphin Area is well defined by a low resistivity feature. This resistivity survey in conjunction with soil geochemistry and re-interpretation of previous drill results, provided the guidance for resource definition and expansion in the Dolphin area. In 2011 exploration focused on resource definition commenced.

TIMELINE OF RESOURCE DELINEATION AT GOLDEN SUMMIT

- 2011

- 1st NI 43-101 compliant Mineral Resource was calculated using previous drilling completed in the Dolphin area (77 drill holes 11,802m.) Using a 0.3 g/t cut-off grade, indicated mineral resources totaling 7,790,000 tonnes grading 0.695 g/t (174,000 ounces) and Inferred mineral resources totaling 27,010,000 tonnes grading 0.606 g/t (526,000 ounces) were estimated.

- 29 core holes (6,329.5 meters) in the Dolphin area and 18 core holes (3,509.9 metres) in the Cleary Hill area were drilled.

- Updated NI 43-101 was released in December using a 0.3 g/t cut-off resulted in an increase in the Indicated mineral resource category to 17,270,000 tonnes at 0.62 g/t (341,000 contained ounces) and 64,440,000 tonnes at 0.55 g/t (1,135,000 contained ounces) in the Inferred mineral resource category.

- 2012

- A further 55 core holes were drilled (16,602.6 meters).

- October 2012, an updated NI 43-101 resource expanded the Dolphin Resource to encompass the eastern portion of the Cleary Hill area. Using a 0.3 g/t cut-off the indicated mineral resource category increased to 73,580,000 tonnes at 0.67 g/t (1,576,000 contained ounces) and the inferred mineral resource category to 223,300,000 tonnes at 0.62 g/t (4,437,000 contained ounces).

- 2013

- An additional thirteen core holes (5,138 meters) were drilled, and an updated NI 43-101 compliant gold resource was calculated for the Dolphin/Cleary area based on the ten holes completed during the winter drill program, of which eight were incorporated into the Resource. Using a 0.3 g/t cut-off this resulted in an increase in the Indicated mineral resource category to 79,800,000 tonnes at 0.66 g/t (1,683,000 contained ounces) and 248,060,000 tonnes at 0.61 g/t (4,841,000 contained ounces) in the Inferred mineral resource category. Three additional holes were drilled after the updated resource was completed and were not included in the mineral resource update.

- 2016

- As part of the preliminary economic assessment (“PEA”) a conceptual open pit, based on $1300 Au, was produced by Tetra Tech. As a result, only blocks falling within this pit were reported as a mineral resource using a 0.3 g/t cut-off.

| Golden Summit Mineral Resource (US $1300 - Pit Constrained) |

Grade (g/t) Au | Tonnage | Contained Ounces |

|---|---|---|---|

| Current Indicated Mineral Resource | 0.69 | 61,460,000 | 1,363,000 |

| Current Inferred Mineral Resource | 0.69 | 71,500,000 | 1,584,000 |

- 2017

- In 2017 a total of 27 holes were drilled in an area north of the current resource area to determine if the current oxide resource could be expanded to the north as well as to establish boundaries to the current oxide resource. A series of vertical holes, spaced roughly 50 metres apart, were drilled to an average depth of 70 metres. The results of the 2017 program demonstrated the potential for expansion of the current oxide resource at Golden Summit with the majority of the holes returning average grades above the internal cut-off used in the Preliminary Economic Assessment completed in January 2016.

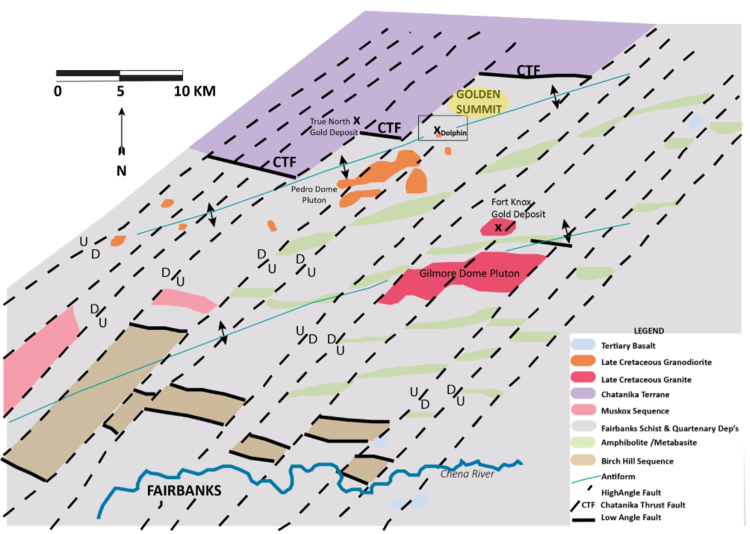

Geological Setting

General geology of the Fairbanks Mining District, Alaska. Data from Newberry, and others, 1996 modified by Avalon Development, 2008, Freegold Ventures, 2021.

There are three main rock units found throughout the property in particular, Fairbanks Schist, Chatanika Terrane, and intrusive rocks. Both the Fairbanks Schist and Chatanika Terrane have been subjected to one or more periods of regional metamorphism. The intrusive bodies are post-metamorphism. Chatanika Terrane rocks lie structurally above the Fairbanks Schist and north of the Chatanika Thrust fault and comprise the northernmost portion of the property. Intrusive rocks are relatively minor on the Property, and are primarily represented by the Dolphin stock, although small granitic dikes are known in several locations. The Dolphin stock is located on the ridge between Bedrock and Willow Creek. Initial diamond core logging identified five intrusive phases within the Dolphin stock, including: 1) fine- to medium-grained, equigranular to weakly porphyritic biotite granodiorite; 2) fine- to medium-grained, equigranular to weakly porphyritic hornblende-biotite tonalite; 3) fine-grained biotite granite porphyry; 4) fine-grained biotite rhyolite to rhyodacite porphyry; and 5) rare fine-grained, chlorite-altered mafic dike.

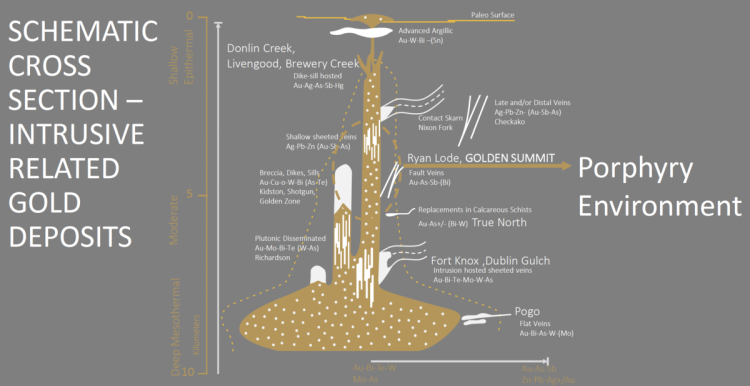

Schematic cross section – intrusive related gold deposits. Data From Lang and Baker, 2001, modified by Avalon Development and Freegold

Small dikes of granodiorite cutting tonalite have been observed in core, and altered granitic dikes cut both altered and unaltered granodiorite and tonalite. This suggests multiple phases of intrusion and hydrothermal alteration. Two radiometric age dates, including two sericite Ar40/Ar39 plateau age dates (McCoy, 1996), place some constraints on the timing of crystallization and mineralization. The sericite ages were obtained from two different samples representing two distinctly different styles of gold mineralization. One sample, from stockwork style mineralization, was 90.1 Ma. Another sample, from a sericite shear-zone, was 88.3 Ma. These ages are quite similar to ages from Fort Knox (86.3-88.2 Ma). Due to age and chemical similarities, most associate the Dolphin and Fort Knox intrusive rocks with widespread intrusive-related gold deposits in the Tintina Gold Belt.

There are three styles of gold occurrences that have been identified on the Property, including: 1) intrusive-hosted sulfide disseminations and sulfide-quartz stockwork veinlets (such as the Dolphin gold deposit); 2) auriferous sulfide-quartz veins; and 3) shear-hosted gold-bearing veinlets. All three types are considered to be part of a large-scale intrusive-related gold system on the Property.

There are three styles of gold occurrences that have been identified on the Property, including: 1) intrusive-hosted sulfide disseminations and sulfide-quartz stockwork veinlets (such as the Dolphin gold deposit); 2) auriferous sulfide-quartz veins; and 3) shear-hosted gold-bearing veinlets. All three types are considered to be part of a large-scale intrusive-related gold system on the Property.

Mineralization

Historical mining concentrated on narrow high grade veins.

Source: Cleary Hill Mine Photos 1939

Cleary Vein: 191.3 g/t Au/1.52m – GSCL1221

Freegold has intersected these same narrow high grade veins in its drilling.

In the Cleary Hill Area, there are several mapped veins. These veins, the Cleary Hill, Colorado, Wyoming, and Wackwitz veins are not one vein but instead are zones consisting of a wealth of small high-grade veins within a given area (vein swarm) surrounded by a broader envelope of mineralization making an ideal bulk tonnage target. This presence of this vein swarm (the CVS or Cleary Vein Swarm) has the potential to increase the overall resource grade.

The primary driver of the mineralization at Cleary is the multi phase Dolphin intrusive.

Intrusive hosted sheeted quartz veins, stockwork veins and veinlets (tonalite and granite- Dolphin) representing the bulk of the current resource

Several pulses of intrusive events carry the mineralization

Granodiorite being cut by leucocratic granite

Stockwork tonalite being cut by leucocratic granite, with late-stage calcite veins

Alteration

Strong alteration appears to be generally indicative of higher gold values, particularly with strong silicification and sericitization. Most common alteration observed:

- Advanced argillic

- Sericitization

- Silicification

- Albitization with carbonate

Strongly sericitized schist, top of box, 7.5 g/t

Sericitic and albitic alteration in stockworked granodiorite

Argillic altered granodiorite with sulfide veins, 1.025 g/t

Intense argillic alteration

Highly silicified schist

Metallurgical Test Work

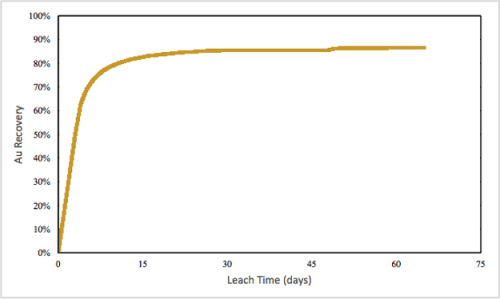

Metallurgical testing for the Project was initiated in 2012 with bottle roll tests being performed on 10 different drill samples with a primary objective of obtaining a preliminary indication of the cyanide leaching characteristics of the oxide mineralogy within the deposit. This test work was performed by Kappes, Cassiday & Associates (KCA). A second set of process test work started in 2013 and continued into 2014 on five different mineralogical composites. These tests were performed by SGS Canada Inc. (SGS). As part of this test work SGS received 279 drill core samples that were composited into five different rock types: oxide, transition, hornfels sulfide, intrusive sulfide, and schist sulfide. This test work primarily focused on investigation of various processing methods for the recovery of gold from sulfide materials. Additional bottle roll and column leach test work was performed later in 2014 to investigate grind sensitivities on four drill core composites of different mineralogy and to examine heap leach behavior in the oxide material. The different composites were designated as oxide, transition, intrusive sulfide, and hornfels sulfide. These composites were initially subjected to coarse bottle roll tests conducted at five different feed sizes.

One column leach test was performed on the crushed oxide composite to determine heap leaching characteristics of the material. These tests were performed by McClelland Laboratories, Inc with results received in January 2015. Gold extractions over 80% were achieved within 14 days on coarse crushed material (80% -25 mm). The column test was permitted to run for 65 days and final extractions were 85% for gold.

Further metallurgical test work to date has indicated that optimum treatment of the sulphide portion of the resource is by flotation of the sulphide followed by oxidation whereupon recoveries in excess of 90% are achieved.

PRELIMINARY ECONOMIC ASSESSMENT HIGHLIGHTS:

The following preliminary economic assessment analysis includes inferred mineral resources, which are considered too speculative geologically to have economic considerations applied to them, and are therefore not categorized as mineral reserves. There is no certainty that the preliminary economic assessment will be realized.

Project cost estimates and economics are prepared on an annual basis. Based upon design criteria presented in the Tetra Tech Report, the level of accuracy of the estimate is considered ±35%.

NI 43-101 Technical Report Golden Summit Project. Preliminary Economic Assessment Fairbanks North Star Borough, Alaska USA, as amended and restated May 11, 2016.

A Two Phased Project:

Based on a gold price of US$1,300/oz, highlights of the Golden Summit Project PEA include:

- A post-tax NPV5% and IRR of $188 million and 19.6% respectively;

- A mine life of 24 years with peak annual gold production of 158,000 ounces and average annual gold production of 96,000 ounces;

- 2,358,000 ounces of doré produced over life of mine;

- Total cash cost estimated at US$842/oz Au (including royalties, refining and transport);

- Ability to execute Phase 1 with low initial capital; initial and sustaining capital costs, including contingency, estimated at $88 million and $348 million respectively;

- A payback of 3.3 years post-tax; and

- Favorable geopolitical climate; completion risk is offset through strong legislative and financial support at state and federal levels.

| Description | Value | Unit |

|---|---|---|

| Net Present Value (0%) | $533,613 | $000s |

| Net Present Value (5%) | $187,742 | $000s |

| IRR | 19.6% | % |

| Payback | 3.3 | Years |

Source: NI 43-101 Technical Report Golden Summit Project. Preliminary Economic Assessment Fairbanks North Star Borough, Alaska USA, as amended and restated May 11, 2016

| Gold Price | NPV @ 5%(Millions) |

|---|---|

| $1,100 | $19 |

| $1,200 | $107 |

| $1,300 | $188 |

| $1,400 | $265 |

| $1,500 | $339 |

The term “Mineral Resource” used above is defined per NI 43-101. Though Indicated Mineral Resources have been estimated for the Project, this PEA includes Inferred Mineral Resources that are too speculative for use in defining Mineral Reserves. Standalone economics have not been undertaken for the measured and indicated mineral resources and as such no reserves have been estimated for the Project. Please note that the PEA is preliminary in nature, that it includes inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Without limitation, statements regarding potential mineralization and resources, exploration results, and future plans and objectives of the Corporation are forward looking statements that involve various risks. Actual results could differ materially from those projected as a result of the following factors, among others: changes in the price of mineral market conditions, risks inherent in mineral exploration, risks associated with development, construction and mining operations, the uncertainty of future profitability and uncertainty of access to additional capital. See Freegold’s Amended and Restated Annual Information Form for the year ended December 31st, 2020 filed under Freegold’s profile at www.sedar.com for a detailed discussion of the risk factors associated with Freegold’s operations